美國時代雜誌評選為美股史上最神話的人物,

美國時代雜誌評選為美股史上最神話的人物,Jesse Livermore

由於他所使用的技巧造就他在1920s and 1940s的傳奇故事,而這個傳奇故事不僅僅只有輝煌的戰績, 災難性的虧損也在Wall Street為人們津津樂道.引述他在一本個人回憶錄"Reminiscences of a Stock Operator"中所提到的經典名言如下:

"There is nothing new in Wall Street. There can't be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again."

任何在股票市場中發生的事情以前已發生過而且會再次發生.

"The point is not so much to buy as cheap as possible or go short at top price, but to buy or sell at the right time."

重點不是盡可能的去買最便宜的股票或賣在最高點, 而是買或賣在對的時間.

以下是Jesse Livermore的交易原則:

- Buy rising stocks and sell falling stocks.

- 買漲升中的股票和賣出下跌中的股票

- Do not trade every day of every year. Trade only when the market is clearly bullish or bearish. Trade in the direction of the general market. If it's rising you should be long, if it's falling you should be short.

- 不要每年每天地交易. 交易只有在市場有明確牛市或者熊市時. 交易與總體市場同向.如果市場正在漲你應該做多, 如果它正在跌你應該放空.

- Co-ordinate your trading activity with pivot points.

- 你的交易活動應與你的關鍵點協調一致.

- Only enter a trade after the action of the market confirms your opinion and then enter promptly.

- 只有在市場確認你的看法後才進行交易並且立即進入.

- Continue with trades that show you a profit, end trades that show a loss.

- 持續讓你賺錢的交易, 中止讓你虧損的交易.

- End trades when it is clear that the trend you are profiting from is over.

- 當讓你獲利的趨勢明顯地結束時,中止交易.

- In any sector, trade the leading stock - the one showing the strongest trend.

- 在任何類股,交易領先股-顯示最強烈趨勢的股票.

- Never average losses by, for example, buying more of a stock that has fallen.

- 從不攤平損失,舉例, 買更多下跌的股票.

- Never meet a margin call - get out of the trade.

- 從不面臨斷頭-立即出場

- Go long when stocks reach a new high. Sell short when they reach a new low.

- 當股票創新高時做多,當股票創新低時放空.

- Don't become an involuntary investor by holding onto stocks whose price has fallen.

- 不要成為一個不自覺持有已經下跌股票的投資人

- A stock is never too high to buy and never too low to short.

- 股價永遠不會太高而不能買且永遠不會太低而不能賣.

- Markets are never wrong - opinions often are.

- 市場永遠是對的-輿論通常是對的.

- The highest profits are made in trades that show a profit right from the start.

- 從一開始就顯示獲利的交易才會創造最高的獲利.

- No trading rules will deliver a profit 100 percent of the time.

- 沒有一個交易法則可以保證100%持續的獲利.

Livermore said:

"I never benefited much from a move if I did not get in at somewhere near the beginning of the move. And the reason is that I missed the backlog of profit which is very necessary to provide the courage and patience to sit thourgh a move until the end comes - and to stay through any minor reactions or rallies which were bound to occur from time to time before the movement had completed its course."

如果沒有在走勢的起點附近介入,我不曾在當中受益. 理由是我錯過了提供勇氣與耐心去等待走勢結束所必要的累積獲利, 還有冷靜度過該走勢完成它任務前一直都會發生任何次要的反抗或反彈.

Livermore說:”成功的投資或投機,是針對一個股票下一

Jesse Livermore喜歡交易價錢走勢有明顯傾向的股票,他對有曲

Jesse Livermore寫:無論何時,在我交易前,我已經耐心的等待

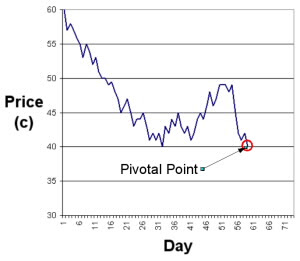

仔細看右圖,在從低點40c的位置反彈之前,趨勢已經向下.這反

假使,股票跌破該點,如37c, Livermore將放空;假使,股票突破該點之 上,如43c, Livermore將買進.在買之後,他會小心注意價位的波動,

上,如43c, Livermore將買進.在買之後,他會小心注意價位的波動,

正常的反作用力:

一旦股票跌破了交易區間,就像右圖的股票,已經跌破向下-

一旦股票跌破了交易區間,就像右圖的股票,已經跌破向下-

Jesse Livermore將尋找以下的徵兆:

@在走勢開始的地方,應該會有異常交易的大量

@在幾天時間裡,通常價位的移動應該是朝同一個方向(向上或向下

@一個正常的反作用力應該注意到-量能與趨勢開始期間所觀察到

@在一兩天內的正常反作用力中,量應該再一次增加,而價位走勢將

source:http://www.jesse-livermore.com/